Strategic Equity Investments

Rice Park Capital provides active capital to early-stage real estate and mortgage technology businesses that we believe are transforming and reshaping their marketplace and have a path to profitability and a strategic exit.

Our focus is on situations in mortgage tech, real estate tech, rental tech, construction tech, and fintech where we can apply our value-add approach to investing.

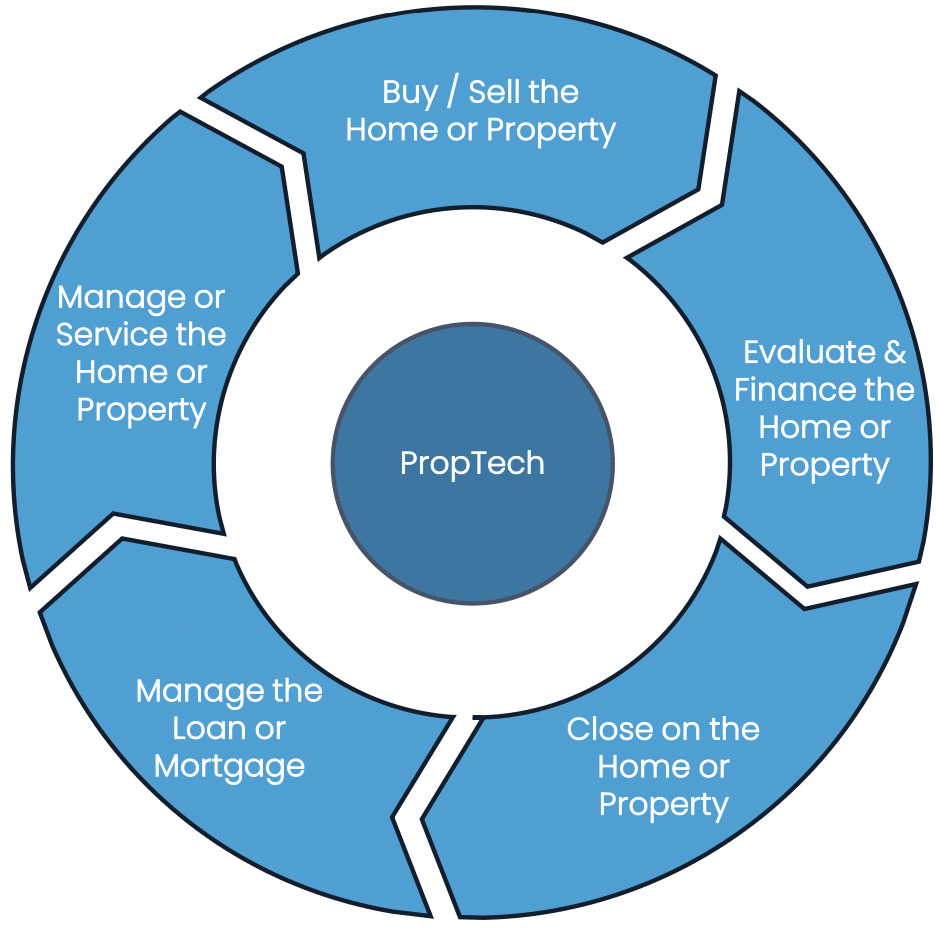

Proptech Sector Overview

Proptech represents a large ecosystem of start-ups and rapidly growing companies that offer technology-enabled and/or innovative products, services, and business models across various aspects of residential and commercial real estate markets.

-

$61 trillion in total assets across residential, commercial, and multifamily real estate1

-

$12.8 trillion in outstanding mortgages2

-

$12 billion invested in Proptech in 20213

“Real estate lags behind most asset classes in digitization and the adoption of technology… Real estate as an industry is therefore less efficient and transparent than most any comparable industry and would appear ripe for disruption.” – Deloitte

Notes: 1) Urban Institute, Nareit Research, Rice Park Research. 2) Federal Reserve of St. Louis Economic Research as of Q1 2022. 3) Keefe, Bruyette & Woods, Inc. Proptech Pulse.

Our Approach

We invest in businesses that we believe have demonstrated a proof-of-concept, have viable products, and need our support and expertise to help them scale.

Focus on Sectors That We Know

Focus on companies that we believe have demonstrated proof-of-concept product-market-fit and have viable products that are ready to be scaled.

Invest in “Commercialization” Phases of Growth

We support businesses that need to build out their organizations to commercialize their product development and go-to-market strategy to then scale growth.

Take an Active Role & Provide Operational Expertise

As operators and entrepreneurs, we believe we know what it takes to scale businesses from start-up through exit. We take an active role with our investments, often getting board seats.

Portfolio Companies

Portfolio News & Featured Articles

Purlin Co. has joined the NAR REACH 2024 Cohort

Purlin Co. has joined the NAR REACH 2024 Cohort. This program, powered by Second Century Ventures and the National Association of REALTORS®, accelerates tech innovations in real estate.

SitusAMC’s Strategic Investment in Candor Technology, Inc

New York, NY (04/11/2024) – SitusAMC, the leading provider of services and technology to the commercial and residential real estate finance industry, today announced a series of strategic business moves aimed at streamlining its focus […]

NMP Magazine with Chris Bixby & Ajit Prabhu: When, Where, And How To Incorporate AI Into Your Mortgage Business

National Mortgage Professional on You cannot turn a page in an industry publication without landing on a story about how Artificial Intelligence (AI), automation, and Generative AI impact the mortgage industry. But that does not […]

MBA NewsLink Q&A With Rice Park Capital Management’s Nick Smith and Chris Bixby

March 5, 2024 MBA NewsLink recently interviewed Nick Smith, Founder, Managing Partner and CEO of Rice Park Capital Management, Plymouth, Minn., and Managing Director of Strategic Equity Investing Chris Bixby about their perspectives on the […]

Chrisman Commentary – Daily Mortgage News with Chris Bixby and Mark Hinshaw

2.20.24 Mortgage Scams; Interview with Rice Park Capital Management's Chris Bixby and Candor's Mark Hinshaw; Inventory Shortage Continues

Candor Secures Series B Funding, Led by Rice Park Capital

ATLANTA--(BUSINESS WIRE)--Candor Technology, Inc., a leading provider of automated underwriting technology and other technology enabled solutions for the mortgage industry, announced today it has closed a Series B equity round to expand its Loan Engineering […]

AI-Enabled SMS Integration: Capacity and Textel Join Forces to Transform Customer Support

Capacity, a Rice Park Capital portfolio company and AI-powered support automation platform, has recently acquired Textel, a leading cloud-based texting platform. This strategic collaboration aims to enhance customer experience by integrating AI-driven SMS business...

Rice Park Capital Makes Investment in Purlin, an AI-Led Real Estate Technology Platform

MINNEAPOLIS, June 8, 2023 /PRNewswire/ -- Rice Park Capital Management LP ("Rice Park"), a Minneapolis-based, private investment firm, announces its venture capital strategy ("RPC Ventures") has made an investment into Purlin, a technology company that […]

Chris Bixby’s Q&A with Mortgage Orb: Mortgage Tech Firms Challenged to Navigate Current Economic Headwinds

In a recently published Q&A with MortgageOrb.com by Michael Bates, our very own Chris Bixby shares insights on the mortgage technology landscape from an investor's perspective. As a leader in Rice Park Capital Management, Chris […]

Realized

RE Tech Fund I

Realized Holdings is a technology-enabled platform providing Tax-Optimized Real Estate™ wealth solutions to families that own legacy investment properties and other appreciated financial and capital assets. Investors use the Realized platform to tax-efficiently transfer wealth from legacy properties and assets into passive commercial real estate portfolios customized to their specific needs.

Investment Round: Late Seed

Board: Director

Status: Exited

Minneapolis, MN

Blue Match

RE TECH FUND I

Provider of real estate services intended to revolutionize the old-fashioned methods in real estate. The company’s services give homeowners the ability to sell their homes at a low flat fee with the assistance of a licensed real estate agent, and a team of specialists, enabling them to easily list and sell their homes.

Sitekick

CRE TECH FUND I

Construction site monitoring, harnessing visual image processing, machine learning, and environmental sensors. Their all-in-one solution is a valued offering on Procore, the #1 U.S. construction software platform.

Unreal Estate

RE TECH FUND I

A cost-effective real estate brokerage platform that facilitates seamless transactions for sellers and buyers. With strategic capabilities, they’re converting browsers into sellers, buyers, and borrowers.

Blue Water Financial Technologies

MORTGAGE TECH PUBLIC (NASDAQ: BWV) Fund I SOLD FOR $101M

Blue Water is a leading provider of asset valuation, MSR distribution, MSR hedging, and electronic solutions for MSR investors and mortgage lenders. They offer a platform that provides real-time portfolio visibility and transactional data analysis, driving liquidity in the mortgage asset market. Their services cater to various investor types, mitigating risks and offering tailored solutions, while also providing compliant asset sourcing and a user-friendly platform for financial institutions.

Blue Water was sold to Voxtur Analytics in 2022 for ~$101 million in total consideration at the time of the sale.

Capacity

AI – Saas Fund I

Capacity is an AI-powered support automation platform that connects your entire tech stack to answer questions, automate repetitive support tasks, and build solutions to any business challenge. Capacity was founded in 2017 by David Karandish and Chris Sims.

Purlin

AI – Saas Fund II

Purlin is a tech firm that specializes in developing and providing advanced AI solutions for the real estate sector. Their enterprise-level software tools are designed to help real estate brokerages, teams, and agents generate more leads, advertise properties, identify potential buyers, and streamline the buying and closing process.

Candor

AI – Saas Fund II

Candor Technology, Inc is a leading software provider of automated underwriting technology to the mortgage sector. Their solution consists of the PreQualTM origination solution, the Loan Engineering System for fulfillment, and the innovative CandorPLUSTM hybrid solution. With over 3 years of experience, Candor has facilitated over 2.5 million underwrites for lenders. Additionally, Candor provides a warranty for funded loans that is backed by a AAA rated insurer.