Residential Mortgage Servicing Rights

At approximately $14 trillion¹, in notional size, the U.S. residential MSR market is one of the largest alternative fixed-income markets in the world. The operational and regulatory complexity of the MSR market creates barriers to entry, which provides the potential for enhanced returns to investors over the long term. The partners of Rice Park have significant experience in the MSR market and have built and run large MSR investment businesses at leading financial institutions.

Rice Park has created a comprehensive platform to invest in Agency (Fannie Mae and Freddie Mac) MSR across all market cycles. We invest using a set of key principles:

- Partner with mortgage originators by providing them with unique and innovative capital solutions for their MSR, thereby creating access to substantial asset flow.

- Create key relationships with high quality subservicers to perform the required servicing duties of the MSR portfolio.

- Leverage our experience building and managing large-scale MSR investment platforms to oversee our seller partners and subservicers to ensure a strong control environment.

- Provide our investors with portfolio management expertise and prudent risk management intended to optimize portfolio performance and limit downside risk.

For more information about Rice Park MSR strategies or to inquire about other investment opportunities, please feel free to contact us.

1) Q2 2023, Release Tables: Mortgage Debt Outstanding, Millions of Dollars; End of Period | FRED | St. Louis Fed (stlouisfed.org).

Rice Park Capital Management Closes on $300 Million Capital Commitment for its MSR Strategy

“Through our partnership with Rice Park, we’re excited to provide liquidity to MSR holders, supporting the US mortgage market and homeownership, and do so by partnering with best-in-class originators and sub-servicers for the benefit of borrowers. Rice Park’s expertise in MSR and more broadly residential mortgage products will enable our clients to access a large market in a prudent way.”

Thierry Masson

M&G Head of Origination – Americas.

MSR Defined

- Mortgage servicing rights (MSRs) are the contractual right to servicing mortgage loans, including the right to receive payments for servicing mortgage loans

- RPC owns an entity with the licenses and GSE approvals² required to be a contractual owner of MSR

- RPC outsources the operational servicing of the loan portfolio underlying the MSR (payment processing, collection, etc.) to a select network of third-party subservicers

- RPC has an internal team that provides oversight and monitoring of its subservicers to ensure quality control and compliance

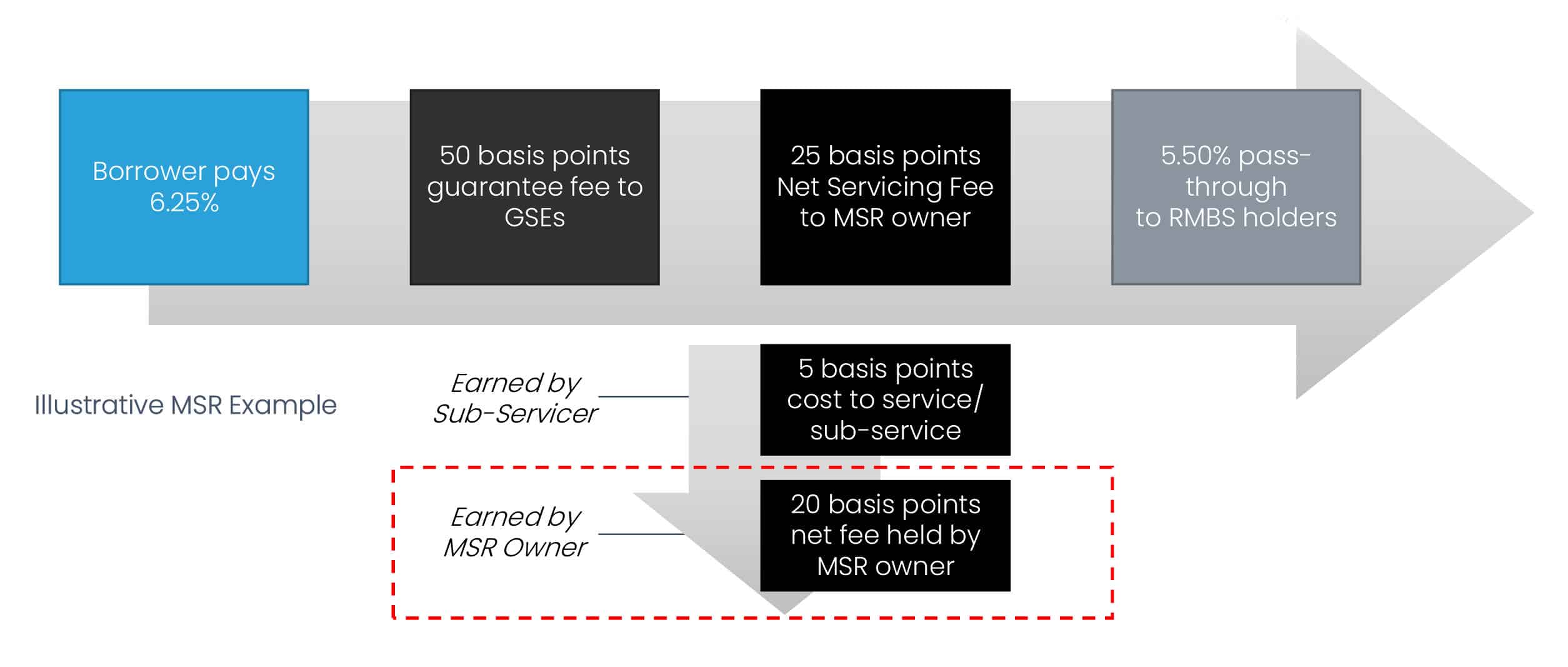

- The Net Servicing Fee for MSR is the difference between the Gross Servicing Fee and the coupon on the RMBS, less the fee paid to the GSEs to guarantee the mortgage

- Additionally, in many cases, the holder of MSR has the right to receive float income on principal and interest, taxes, insurance, late fees, and ancillary income before payments are remitted to the GSEs

2) Rice Park Capital’s entity is an approved seller/servicer of Fannie Mae and Freddie Mac loans

Portfolio Companies

Nexus Nova

Nexus Nova LLC is a subsidiary of Rice Park Capital Management LP, an investment firm based in Minneapolis. Nexus Nova specializes in investing in mortgage servicing rights and has quickly become a market leader in this area. As a Freddie Mac approved servicer, Nexus Nova has already achieved significant recognition in its industry, having been ranked a top 50 GSE MBS servicer for Quarter 2, 2023 by Inside Mortgage Finance Publications. In just one year since beginning to invest in mortgage servicing rights, Nexus Nova has increased its holdings from $15.1 billion to approximately $24 billion of GSE MSR. The success of Nexus Nova can be attributed to the extensive mortgage investment knowledge and experience of Rice Park Capital Management.